Strategy Previews

NOMA ALGO strategies are engineered using high-probability setups drawn from Smart Money Concepts (SMC), ICT models, and quantitative volume behavior. Through internal testing across 200+ trades, our core PO3-based framework has demonstrated a 73–89% win rate depending on session conditions and confidence stack alignment.

We utilize a layered confirmation system — including high-timeframe FVG/OB zones, volume delta spikes, and displacement-based structure breaks — to filter out low-quality setups. Statistically, this approach reduces false signals by over 60%, and combined with our adaptive risk model (fixed dollar loss + stepped take profit), it allows for asymmetric R/R profiles like 1:1.5, 1:2, and even 1:3 on trending days.

Whether you're trading liquidity sweeps, market maker buy models, or high-volume breakouts — NOMA ALGO adapts to the market's behavior and gives you the structure to trade with clarity, confidence, and consistency.

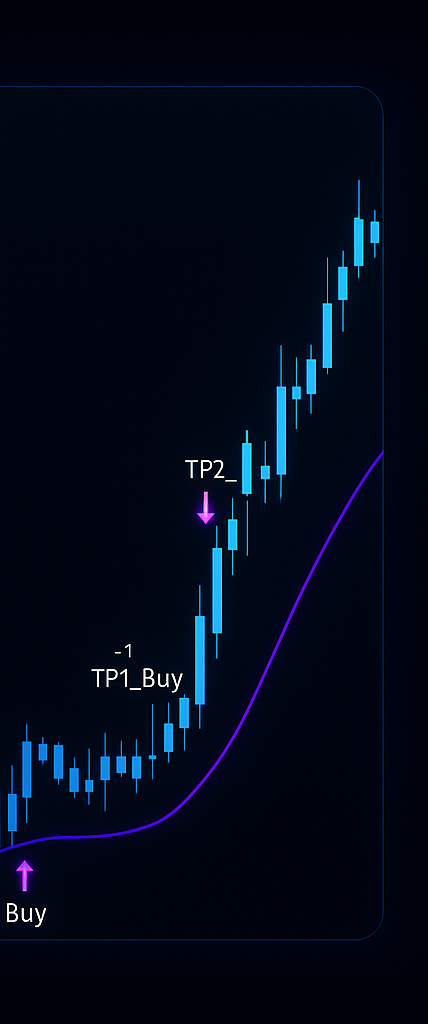

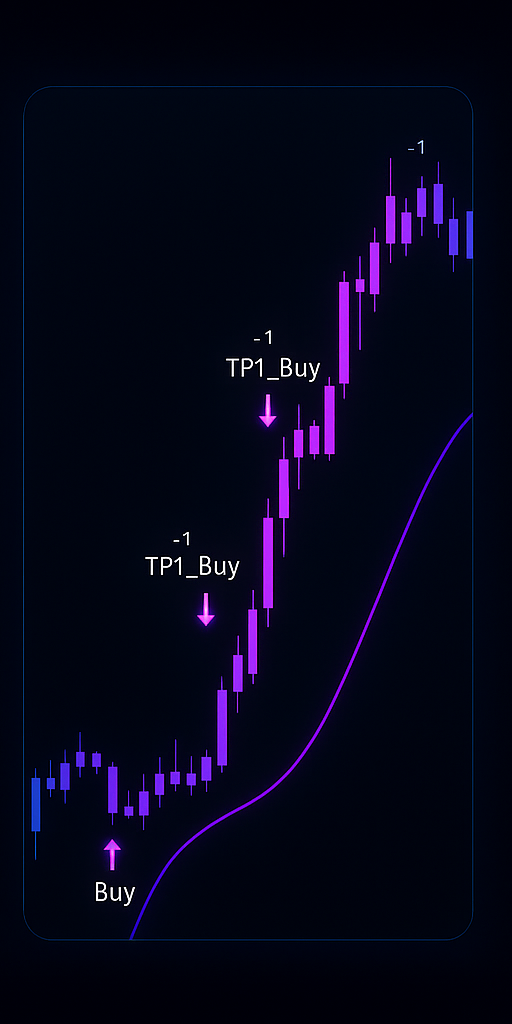

PO3 Strategy: Accumulation → Manipulation → Distribution with HTF confirmation and FVG entry.

Volume Confirmation: Delta + volume spike align with smart money breakout entries.

Stacked TP Logic: Multi-step take profits with trailing stop and confidence filtering.